Banking has come a long way since the days of standing in long queues and filling out endless paperwork. The advent of technology has brought about the rise of online banking, which has completely revolutionized the banking industry. With online banking, you can carry out most of your banking transactions from the comfort of your home, office or anywhere else with an internet connection. However, there are still those who prefer traditional banking methods. In this article, we'll be examining the differences between traditional and online banking to help you make an informed decision.

Traditional Banking

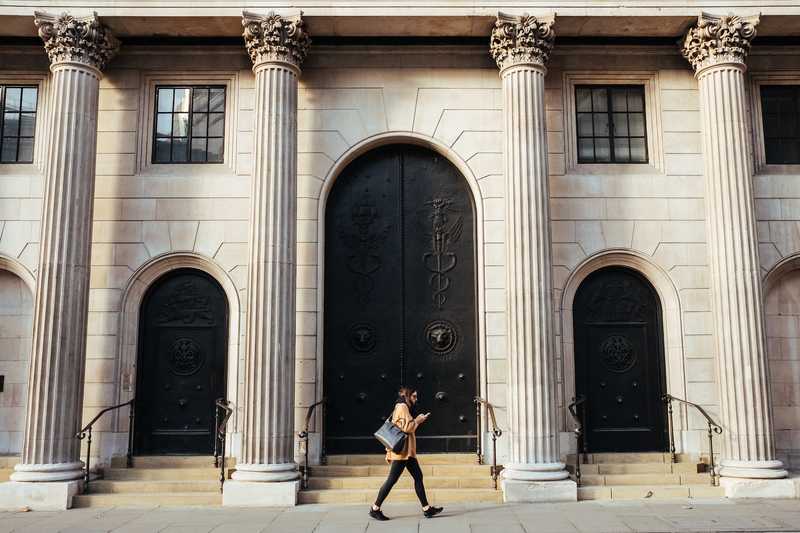

Traditional banking refers to the physical brick-and-mortar bank branches that we've become accustomed to over the years. It involves customers going to the bank to carry out their transactions in person. Traditional banks offer a range of services, including savings and checking accounts, loans, mortgages, credit cards, and investment products.

Advantages of Traditional Banking

-

Face-to-face interaction: Traditional banking allows you to interact with a bank representative in person. This means you can ask questions, get advice, and have any concerns addressed immediately.

-

Cash deposits and withdrawals: With traditional banking, you can easily deposit and withdraw cash at a physical bank branch. This can be convenient for those who need to deposit or withdraw large sums of money.

-

Access to a wider range of financial services: Traditional banks offer a wide range of financial products and services, including loans, mortgages, and investment products.

Disadvantages of Traditional Banking

-

Limited hours of operation: Traditional bank branches are open for limited hours and are often closed on weekends and holidays. This can be inconvenient for those who have busy schedules and can't make it to the bank during working hours.

-

Longer wait times: Traditional banking often involves waiting in long queues, which can be time-consuming and frustrating.

-

Higher fees: Traditional banks often charge higher fees for their services compared to online banks.

Online Banking

Online banking, also known as internet banking or e-banking, is a type of banking that allows customers to carry out financial transactions over the internet. It involves using a computer or mobile device to access your bank account and carry out transactions. Online banking offers a range of services, including checking and savings accounts, loans, mortgages, credit cards, and investment products.

Advantages of Online Banking

-

Convenience: Online banking allows you to carry out most of your banking transactions from anywhere with an internet connection, whether it's at home, at work, or on the go.

-

24/7 access: Unlike traditional banking, online banking is available 24 hours a day, seven days a week. This means you can carry out transactions at any time, even outside of regular banking hours.

-

Lower fees: Online banks often have lower fees than traditional banks, as they have fewer overhead costs.

Disadvantages of Online Banking

-

Limited face-to-face interaction: With online banking, you don't have the same level of face-to-face interaction as you do with traditional banking. This can make it harder to get advice or have any concerns addressed immediately.

-

Limited cash access: With online banking, it can be more difficult to deposit or withdraw cash. While some online banks have partnerships with physical banks or ATMs, others may not have this option.

-

Security concerns: Online banking can be vulnerable to security breaches, such as hacking or identity theft. It's important to take steps to protect your personal information and accounts.

Conclusion

Both traditional and online banking have their pros and cons, and the choice between them ultimately depends on your personal preferences and banking needs. If you prefer face-to-face interaction and the ability to deposit or withdraw cash easily, traditional banking may be the better option